Need to know how much to pay for your car road tax? You can check the road tax amount by looking at your car registration card or Vehicle Ownership Certificate (replacement for Car Registration Card). Or, look at your Road Tax Disc sticker which will display the road tax amount paid. Otherwise, use the road tax calculator below to check Road Tax amount.

Road Tax calculator (power by oto.my)

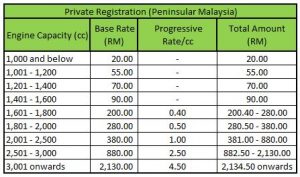

If you wish to understand the calculation behind the road tax amount payable, below is the chart to help you better understand Malaysia Road Tax structure. Below Tables is the road tax structure for Peninsular Malaysia only. East Malaysia is slightly cheaper but table not included.

To calculate road tax payable, simple refer to the below 3 tables

For private registered vehicles, except vehicles that are MPV / SUV / Pick-up category, refer to this table to calculate the road tax amount payable.

For private registered vehicles, except vehicles that are MPV / SUV / Pick-up category, refer to this table to calculate the road tax amount payable.

Example: A Honda Accord 2.0 that registered cc is 1997. The road tax payable is RM378.50

Calculation: Base bracket – RM280.00

Progressive ( 1997 – 1800) x 0.50 = RM98.50

Actual Road Tax payable = RM378.50

For Company Registered vehicles (except for MPV / SUV / Pick-up), refer to Company Registration Table for road tax amount payable. Using the same Honda Accord (1997cc) as example, the road tax amount for a company registration accord will be RM

For Company Registered vehicles (except for MPV / SUV / Pick-up), refer to Company Registration Table for road tax amount payable. Using the same Honda Accord (1997cc) as example, the road tax amount for a company registration accord will be RM

Calculation : Base Bracket RM560.00

Progressive (1997 – 1800) x 1.00 = RM197

Actual Road Tax Payable = RM757.00

However, for MPV / SUV / Pick-up category of vehicle, either private registration or company registered, the rate is the same. Refer to MPV / SUV / Pick-up Table for Road Tax calculation. Taking a Toyota Alphard 2.5 ( 2493 cc) as an example:

However, for MPV / SUV / Pick-up category of vehicle, either private registration or company registered, the rate is the same. Refer to MPV / SUV / Pick-up Table for Road Tax calculation. Taking a Toyota Alphard 2.5 ( 2493 cc) as an example:

Base Bracket = RM440.00

Progressive (2,493 – 2,000) x 0.80 = RM394.40

Actual Road Tax Payable = RM834.40